Times are getting tougher for financial institutions (FIs) and banks. Given the current global turmoil, pandemic related lockdown, all time low interest rates, low credit off-take, the situation is likely to worsen and non-performing loans (NPL) are likely to increase. Thus, banks and FIs need to focus on their collection strategy to withstand these tough times. This strategy should not only be focussed on existing accounts but should also be directed in improving collection efficiencies towards their NPL accounts.

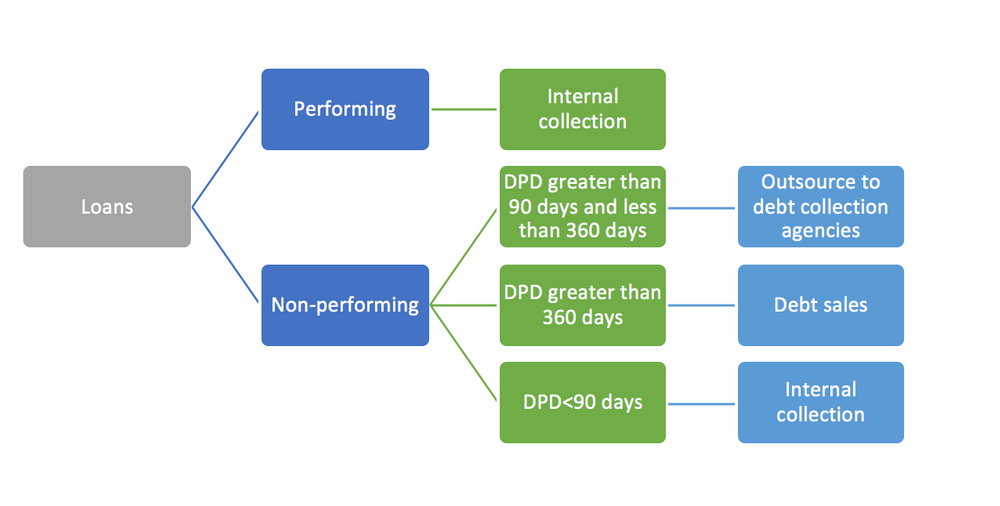

Collection strategy of NPL accounts begins with portfolio classification and bucket categorisation sorted as performing loans DPD 0-30, 30-60, 60-90, DPD 90-360 days and DPD>360 days. Once the portfolio has been clearly identified and bucketed, creditors need to decide upon which portfolio to be collected internally, which to be outsourced and which to be sold. The following table can be followed to recognise the same:

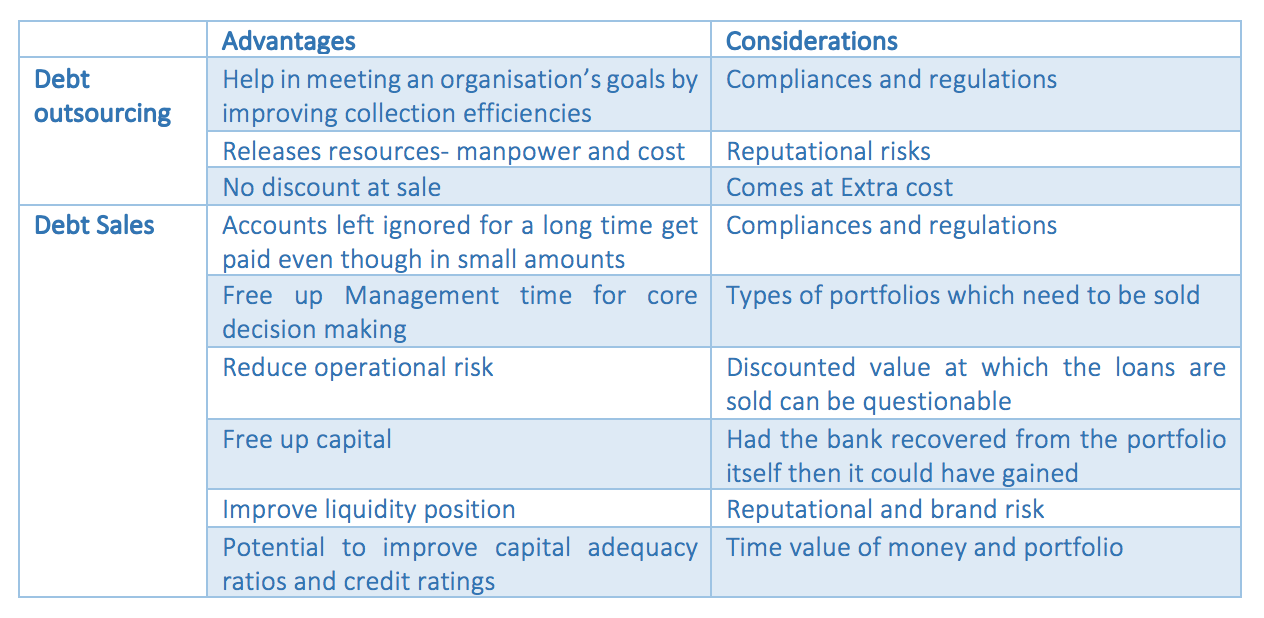

At times, banks and FIs assume that debt collection outsourcing and debt sales are the same concepts. However, the two models are completely different and are used at different point of times for a completely different set of delinquent portfolios. Thus even though the end purpose of the two are same ie both help in resolution of stressed assets, however, they come into play at different points of time for different set of accounts.

Debt Outsourcing vs Debt Sale

Debt Outsourcing: Debt outsourcing refers to the process where the collection of accounts by banks or FIs is outsourced to a third party. These accounts can either be good account or delinquent accounts. However, most of the times accounts which are delinquent (DPD 90-360 days) are outsourced to debt collectors for recovery.

Collections agencies act as third parties for banks and FIs that seek to outsource their collection needs and provide consumers a point of contact for paying off their debts. Delinquent accounts that would otherwise sit unpaid are compiled into a portfolio for the debt collection agency to manage. These debts are still owned by the crediting company. The collection agency then functions as a liaison between the creditor and consumer.

Debt Sale: When banks and financial institutions (FIs) sell their portfolios to a third party or collection agencies, it is called debt sales. The sale of debt by lenders/ creditors to buyers is generally done at a discounted rate. When a debt buying company purchases an account from a creditor, it purchases the contracts and all rights, benefits and liabilities that were held by the creditor associated with the contract. These purchases can include accounts that are performing (i.e., making payments), as well as those that are nonperforming (in default). However, most of the time debt sales is mostly performed on stressed portfolios (DPD>360 days) which are mostly deemed unrecoverable. Debt sales is generally resorted by lenders for the following reasons:

• Strategic sales to rebalance their exposures either in sectors or in certain large conglomerates or

• Reducing overall book size by selling the complete portfolio to free up capital or

• As a means to achieve resolution of stressed assets by extinguishing the exposures.

These buyers can either be other banks, asset resolution companies or specialised agencies/ third party companies which purchase such loans. Debt buyers primarily purchase delinquent debt arising from credit cards, automobile loans, medical bills, mortgages, retail and consumer loans. Debt sellers no longer own the loan and are able to concentrate on their core lending businesses.

Why Should Banks and FIs Sell or Outsource?

The main reasons why banks and FIs outsource their collections to a reputed vendor is mainly to ease their operational challenges. Retail loans which have a large geographical spread require regular follow-ups from customers for collections. Outsourcing is a beneficial technique for large volume and small quantum sized loans where banks and FIs can do it in a cost effective manner without channelizing their own resources and energies towards the same. Outsourcing is preferred for delinquent buckets of 90-180 day DPD and 180-360 days DPD.

Debt sales is also a preferred tool in case of retail delinquent accounts. Delinquent portfolios with DPD > 360 days where the originator has made substantial efforts and has been unable to collect the same, is generally sold to third parties. The same helps the originator in at-least getting some value from a bad portfolio.

In a nut shell, debt collection starts first at a creditor’s level. Once the creditor is unable to collect the same and accounts become delinquent a special emphasis on collection should be carried. All accounts with DPDs of 90 days or more, can be outsourced to a collection agency. Post outsourcing, despite sufficient efforts of specialised agencies and originators some part of the portfolio will still move into higher buckets and will remain delinquent. In such a scenario, the same should be sold in-order to free up the capital.

International (EN)

International (EN) Indonesia (ID)

Indonesia (ID) Tieng Viet (VN)

Tieng Viet (VN) India (EN)

India (EN)