The global debt has touched an all-time high of nearly $255 trillion in 2019 which includes the government, household, and corporate debt. Overall, the global debt-to-GDP ratio has peaked at 322%. The Emerging markets added over $3.4 trillion debt in 2019 resulting in debt to GDP ratio of 220% up from 147% in 2007. The World Bank, IMF as well as many other specialised financial research institutes have been warning about the sustainability of this debt bubble.

The danger signals are not alleviating anytime soon. High borrowing and lending, easy availability of credit, falling interest rates, advent of financial technology, and the current COVID -19 crisis all are gesturing towards rise in further retail debt. Given the weakening GDP growth, job losses, disruptions in world trades, capital constraints, intensifying bad debts and high leverage ratio, countries and their banks will have limited appetite for increasing their asset books size.

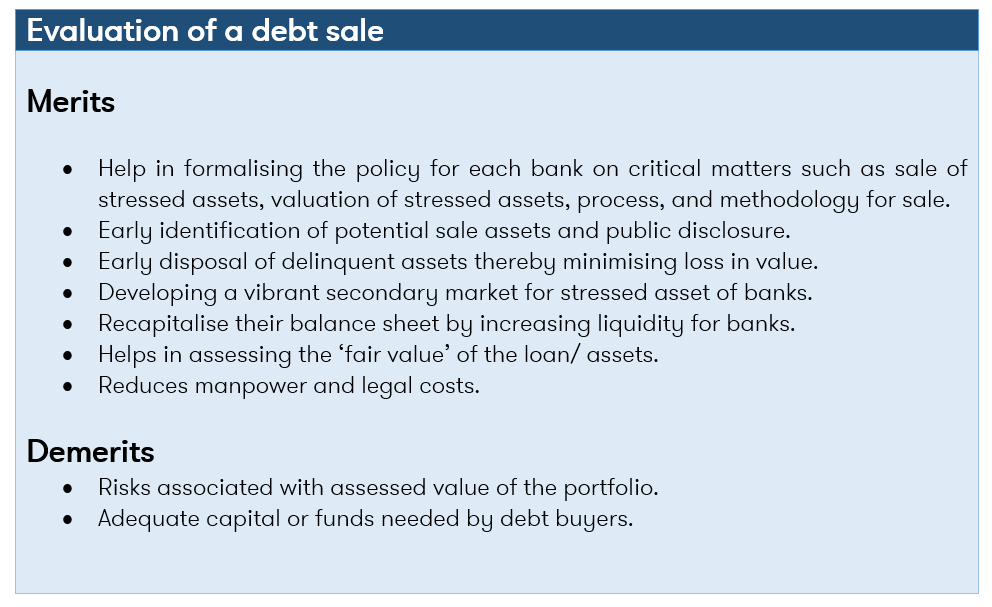

To maintain financial prudence and a sound banking system with moderate bad debt levels, financial institutions will need to figure out efficient risk management. Traditional solutions such as bank mergers, debt refinancing, fiscal and monetary loosening or establishment of bad banks have not helped much in resolving the debt problems. Thus, is debt sale the answer to the rising loan bubble?

The process of debt sale

Debt sale refers to the deleveraging of existing debt portfolios by lenders to buyers. When a debt buying company purchases an account from a creditor, it purchases the contracts and all rights, benefits and liabilities that were held by the creditor associated with the contract. These purchases can include accounts that are performing with payments made, as well as those that are non-performing and in default. Debt sales is generally carried out by lenders for the following reasons:

- Strategic sales to re-balance their exposures either in sectors or in certain large conglomerates.

- Reduce overall book size by selling the complete portfolio to free up capital.

- Lastly, there are regulations that obligates banks and other credit institutions to create reserves for non-performing loans called Loan Loss Provision (LLP). This creates a negative impact on a bank’s balance sheet. Hence, by selling the portion of debt portfolio, it will unfreeze reserves and these institutions will receive fresh cash and extinguish exposures.

These buyers can either be other banks, asset resolution companies or specialised third party companies that purchase such loans. Debt buyers primarily purchase delinquent debt arising from credit cards, automobile loans, medical bills, mortgages, retail, and consumer loans.

The practice of debt sales is highly widespread and successful in the Western economies. While debt sale of secured loan portfolios is already a common practice in Asia, the debt sale of unsecured retail loan portfolios is slowly catching up. The growth of debt buying industry had been triggered by increase in personal loans like credit card debt, student loans and change in receivables management strategy of large banks to sell their portfolio. As per a study by FTC, 75% of the debt sold by lenders is from credit cards followed by 10% of mortgages. The same study found that five out of six big credit card issuers in USA were selling their delinquent credit card debt portfolios to debt buyers.

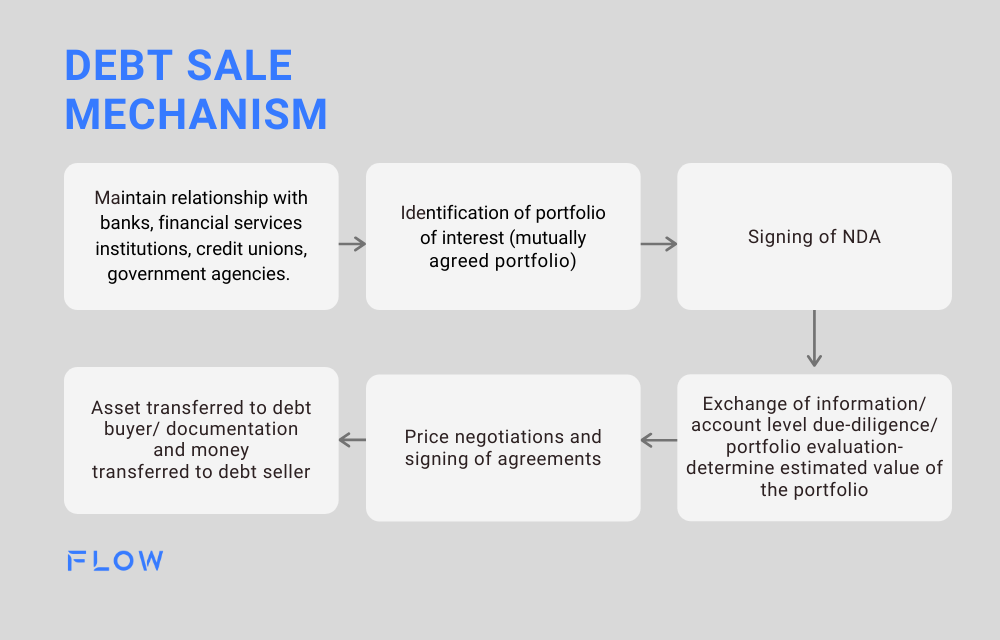

Mechanism for debt sales

The debt portfolio to be sold is generally categorised in 3 categories namely: Fresh debts which are typically up to 6 months in age and the original creditors sell them without making any attempt to collect following charge-off; Primary debts which are typically up to 12 months in age, and the original creditors have hired third party debt collectors to try to recover following charge-off; Secondary and Tertiary debts which are typically up to 18 or 30 months in age respectively and the original creditors will hire more third-party debt collectors to attempt to recover following charge-off.

For unsecured consumer loans, credit institutions usually attempt to recover the Fresh debts within their in-house debt collection divisions. For some debts with (Days Past Due) DPD of 180-360, it could still be defined as Fresh. However, beyond this are the washed cases, not that old debts, usually DPD 180-360-720, that will be allocated to a debt collection agency a few times. This is when the non-performing loans start putting a strain on the balance sheet. This indicates that it is time to sell off these loan portfolios.

Lastly, credit institutions which do not have effective NPL management strategy accumulates written-off debts with 3 – 7 years onward of delinquency for many years until modern collection practices are developed. It is important for these creditors to identify which debt portfolios should be deleveraged, reinvest the money from the sale and reallocate resources within the organisation effectively. For sellers not confident of the right sale price at the beginning can start small, observe the outcome and learn, organise sale auction and improve the outcome.

The growing trend of partnering with third party companies

Institutions in the North American and APAC regions over the years have started outsourcing the debt collection efforts as well as debt sales to third parties. This has helped them in improving their balance sheet ratios as well as given them adequate liquidity. The reason for outsourcing these services have reduced their costs of legal proceedings, manpower and has also helped in increasing their stability. On the other hand these third party agencies have been able to recover monies from these otherwise bad accounts by using advanced technologies and giving them some leeway on their repayment schedules. At times, these third party companies face challenges in terms of regulations, legal hurdles, however, they have been able to tide over using ethical and compliant policies.

When selling loans to third party agencies, it is crucial that the loans are sold to agencies/ companies which have long standing, prudent policies and protect borrowers right. After all, the brand reputation of the credit institutions still carry with the borrowers when the debt portfolios are sold to third parties.

Conclusion

Whether it be the ‘Zombie Banks’ (Banks burdened with bad debt) or banks in good health, all require capital and liquidity to grow. Thus, prudent debt management policies, adequate capital and robust financial systems empowered by stringent regulations is needed for the growth of the banking industry in the future. Prompt resolution measures are necessary to deal with distressed debt for healthy growth in the institution.

International (EN)

International (EN) Indonesia (ID)

Indonesia (ID) Tieng Viet (VN)

Tieng Viet (VN) India (EN)

India (EN)