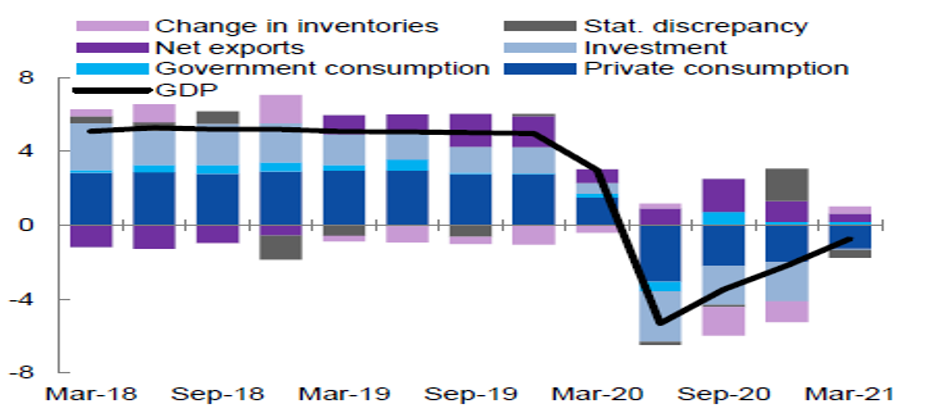

Looking back last year, the pandemic has impacted the economy of Indonesia heavily wherein the country saw a GDP decline by 2.1% in Q1FY21. Till mid-march, there were travel restrictions and partial lockdown till June’21 preventing many firms and shops from operating and discouraging many consumers from shopping. Small and medium-sized firms and businesses, manufacturing, construction and low value-added service sectors were severely affected.

About 1.8 million Indonesians became unemployed between February 2020 and 2021. However, the government supported through a large package that included larger allocations to the health sector, significant increases in social assistance, large tax incentives for corporates, bailouts of SOEs, credit programs for SMEs and equity injections for banks that restructure SME loans, and additional spending by local governments and line ministries. How is the credit market state in Indonesia like in Q1 2022?

Economic Updates

The COVID-19 pandemic and the containment measures affected Indonesian households through three broad channels: (i) the income/employment channel, which includes both labor and non-labor income, (ii) the price channel that may affect the affordability of essential commodities and inflation levels, and (iii) the long-term human capital channel. Indonesia has not been spared by the effects of the pandemic as the country had to remain shut for quite some-time in phases whenever the case load would increase.

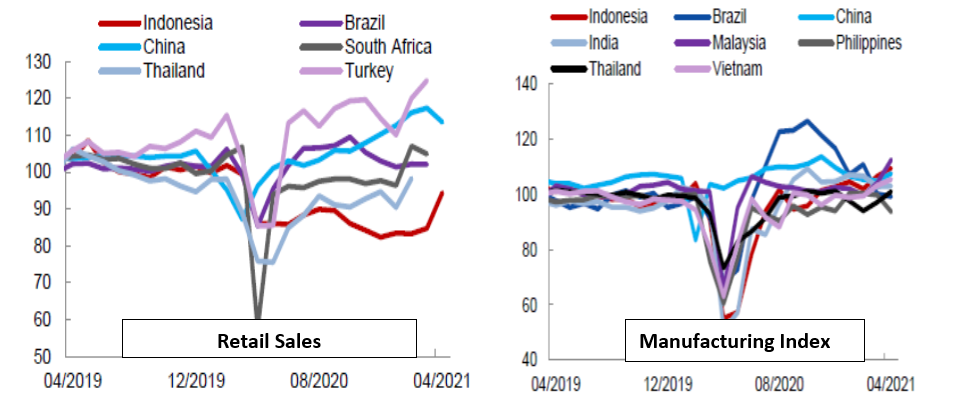

However, post Q1FY21, the rebound has been strong since the country witnessed a strong rebound in retail sales and manufacturing index. Overall the economy is expected to grow by 4.4% in 2021 supported by a gradual improvement in domestic demand, consumption and positive movements from a stronger global economy. This has been led by decline in covid-19 positivity rates, increased vaccination drives, and strong consumer demand. Growth could accelerate to 5.0% in 2022 driven by reduced uncertainty and assuming that the vaccine rollout reaches a critical mass of the population. However, uncertainty remains very high and downsides risks are tilted to the downside.

The government and central bank has been maintaining a consistent policy stance by continuing with supportive interest rates, no withdrawal of moratorium and relief measures etc.

Credit Growth

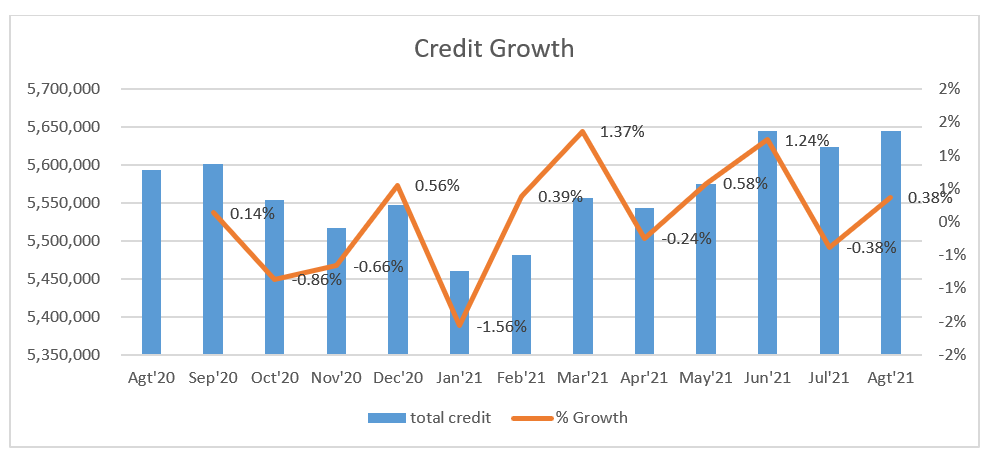

The credit growth has remained almost flat with some fluctuation and upticks. These upticks in credit growth mostly came from stronger growth in working capital and investment loans and support of lower side lending rates provided by the Central Bank.

Overall, the credit slowdown can be seen in comparison to pre-covid era, mainly been across sectors, and different sized firms. “Private credit growth has fallen despite healthy bank balance sheets and moderate corporate vulnerability due to a combination of credit demand and supply constraints, including weak effectiveness of monetary policy transmission, low take-up of risk sharing mechanisms such as guarantees and historically low reliance on banking credit among MSMEs.” Fitch Ratings

Non-Performing Loans

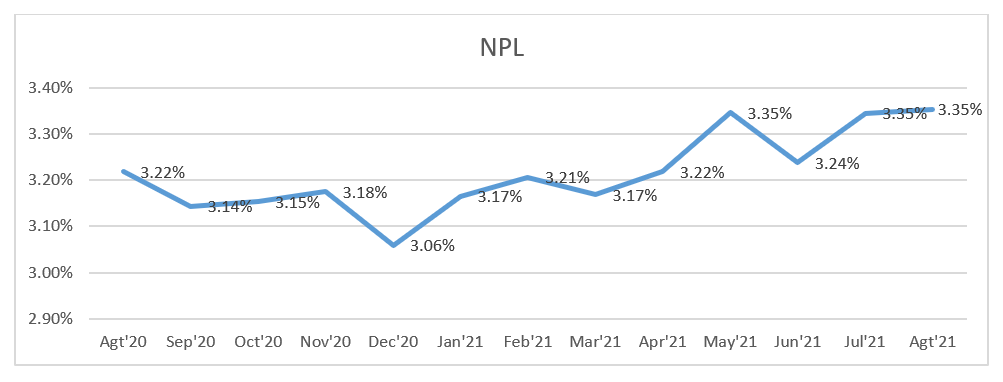

System-wide NPLs have remained high at ~3.35% and the loans at risk ratio defined as the sum of NPLs, restructured loans and special mention loans has also increased sharply (World Bank). This is despite the extension of loan forbearance measures until March 2022 that may temporarily mask the true extent of bank balance-sheet vulnerabilities.

As per a study conducted by World Bank states the following “the reverse stress test performed shows that Indonesia’s banking system would be resilient to a significant NPL shock. The cross country study shows that the NPL ratio would need to reach 19.5 per-cent before 20 percent of the banking system would become insolvent due to depleted capital buffers. How-ever persistently weak credit growth and economic recovery could lead to further deterioration of bank asset quality through linkages with corporate and household sectors.”

Impact of Covid on the Non-Formal Lending Sector and Online-Lending

Indonesia is one of those countries that has a large number of fintech and peer to peer lenders (~116 by end-August 2021). This is in line with the country’s goal of broadening financial inclusion because of the lack of credit opportunities for the informal sector, MSMEs and large credit demand from unorganized sector. Outstanding loans by the sector grew at a CAGR of 86%, from IDR5 trillion at end-2018 to IDR 26 trillion by end August 2021. “The industry continues to grow rapidly, with outstanding industry receivables rising by almost 70% year-to-date in 8M21 (2020: 16%; 2019: 161%), although the asset-quality record remains short and volatile, with the non-performing loan ratio (over 90 days past-due) climbing to 4.8% in 2020 (2019: 3.7%) before easing to 1.8% in August 2021.” (Fitch)

However, overall the sector is still only 1% of the formal sector. The reason for the same is because of the challenges and reputational risks propagated by these companies by using illicit tactics. Thus the need of a robust regulatory and supervisory regime protecting retail and SME borrowers to ensure a prudent conduct and risk management policy is the need of the hour.

Way Forward in 2022

Going forward, its recovery can be boosted further through an accelerated vaccine rollout, and other non-pharmaceutical interventions such as adequate mobility restrictions to get ahead in the race against infections.

Secondly, the government’s accommodative monetary policy and support to private credit to support the real sector would aid in further growth. Lastly, maintaining the fiscal support in the short term while ensuring medium-term sustainability would lead to an improved investor sentiment.

International (EN)

International (EN)