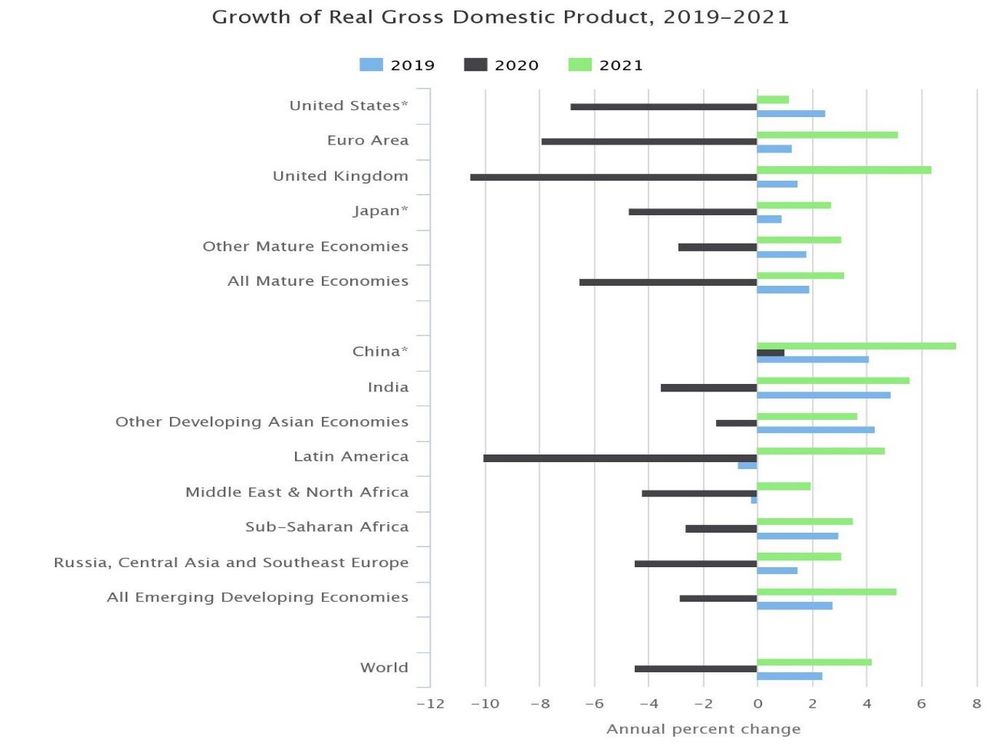

With many countries experiencing a second wave of the pandemic, these countries except China are expected to register an unprecedented slump in real GDP growth rate, meaning job disruptions and general lack of money could increase going forward. Analysts predict a strong rebound in the coming year, but the analysis is heavily reliant on conjecture.

Figure 1: Growth of Real GDP, 2019-2021 Source: The Conference Board

To say that the global economy would be recovered enough to rebound by even 5% in 2021 is to be too optimistic. Many jobs and businesses are collapsing or have already collapsed, but the pandemic is yet to peak in some countries. A recent World Bank report says that although the outcome of COVID-19 is uncertain, it will lead to massive contractions of many economies and fatally damage potential output and labour productivity.

Naturally, credit risk becomes elevated in periods of economic disruptions. Borrowers suddenly find themselves in a situation where they cannot repay the principal and interest owed, meaning debt collection becomes even more crucial. Banks in ASEAN countries were already reeling under the weight of non-performing loans as early as May 2020.

Agility in Technology is Needed for Debt Collection Today

In the coming few months, debt collection will be on the spot from regulators because of piling NPAs. Conventional debt recovery methods will likely attract new legislation aimed at redefining what is acceptable. Implementing agile digital collection methods could be one way for debt collectors to get around the prevailing challenges. In this crisis, debt recovery strategies must have empathy and be efficient.

Agility in technology enables debt collectors to build on professionalism and adherence to ethical standards to create win-win strategies. In this digital age, a great way of leveraging technology is to make alternative data points. Alternative data can be obtained through techniques such as collecting browsing data of borrowers, geolocation, and taking note of the devices they use. The resultant data should be useful when segmenting the borrowers to facilitate appropriate collection strategies.

The categorization of borrowers gives debt collectors clues to the reaction of borrowers toward contact treatment. Making this discovery early enough is good to ensure that whatever strategy is applied during recovery is appropriate to the debtor. Debt collectors should develop contact and treatment strategies that are unique to each segment of borrowers. In-depth segmentation is only possible for collection systems based on digital technology.

At the core, machine learning implements smart algorithms to define better and more useful data points from which collectors can obtain rich insights. The insights go into building the foundation on which all recovery decisions are developed.

Consumer’s Payment Behaviours Are Changing, So Should Collection Strategies

The World Bank considers this the worst recession on record since the Great Depression, even when the end is not sight yet. Millions of people have been furloughed or dismissed from their jobs. In the credit market, the tide of delinquency could be even worse.

It means consumers are much more sensitive than ever before in terms of contact with debt recovery agencies. Uncertainty among the consumers will continue for the entire length of the crisis. Some consumers might even need years to recover from the trauma that the COVID-19 pandemic visited on them.

How can collectors maneuver this sleeper landscape so as not to appear as loan sharks? Change of strategy is the natural first step that debt collectors should take. Among the areas that collectors could institute changes in the call centre. Call centre operators are the frontline whose contact with borrowers defines the directions of the recovery process. Concerning the nature of the current crisis and the impact it has had on the behaviour of borrowers, calling them to follow up on loans could be emotionally draining.

Develop call centre operators’ emotional intelligence to ensure their interaction with debtors does not degenerate into expletives. Emotionally intelligent call operators are better prepared to manage their emotions as well as those of borrowers. Call operators will be able to deal with distressed borrowers by showing empathy and connecting with them.

Deepen the Understanding of the Asian Loan Market

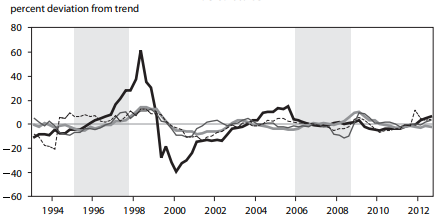

COVID-19 has exposed Asian borrowers and lenders alike to an experience many had not encountered in their lifetime. The last major crisis that the Asian loan market faced was when the Great Recession hit. Asian economies fared better during the 2007/09 Great Recession than during the 1997/98 Asian Financial crisis. Accordingly, the demand for loans and the level of demand for outsourced debt collection services were quite low during the most recent financial crisis known to many Asian borrowers and lenders. Because of this, many lenders seem to have a superficial understanding of the Asian loan market, how borrowers’ behaviour changes in a crisis, and how to handle the changing behaviour better.

Figure 2: Credit and Asset Price Behaviour in East Asia Around 97/98 and 2007/09 Crises Source: Peterson Institute of International Economic

Therefore, the current period is an auspicious moment for lenders to deepen their understanding of the Asian debt market. An excellent place to start is by evaluating the change in the behaviour of borrowers. Moreover, borrowers’ segmentation should generate data that is critical in understanding how to engage borrowers in a crisis. Today more than ever before, the adoption of digital collection strategies is relevant. Digitization of collection would, among other things, enable debt recovery service providers to expand self-servicing options. In the end, lenders will create a fluid and continuous collection process in all seasons.

Bottom Line

These are no ordinary times. Collectors have on their hands a unique moment in which traditional collection strategies do more harm than good. Borrowers are sinking in delinquency and distress levels are high. If collectors implement strategies seen to be too aggressive, the resulting uproar might birth stringent legislation that might hamper the region’s debt collection industry’s efficiency and revenue.

Therefore, lenders need to adopt technology-based strategies that make them agile enough to navigate the current tricky landscape. Digitization of collection is a great starting point. It provides alternative data points to enable lenders to deepen their understanding of the debt market.

International (EN)

International (EN) Indonesia (ID)

Indonesia (ID) Tieng Viet (VN)

Tieng Viet (VN) India (EN)

India (EN)