The effect of economic downturn on the loan market

With COVID-19 pandemic hardly showing signs of abating, many countries have followed suit China’s strategy to go on large-scale lockdowns to contain the spread. While this drastic measure aims to “flatten the curve” and attempts to slow the rate of infection, it drives a sharp fall in consumer and business spending, hence diving the global economy into a deep recession.

Alarmed by warnings of a sharp rise in Non-Performing Loans (NPL), which S&P Global Ratings already forecasts to rise by US$1.1 trillion, there is an uncertainty over how regulators will continue to alleviate the financial impact of COVID-19 and handle an increase in bad debt. But the seeds to this impending credit crisis were sown well before the Dec 2019…

Record level credit disbursement in Asia before COVID-19

Before the outbreak, India, Vietnam and China led the pack of Asian countries when it came to customers and SME’s alike applying for credit online. With many people remaining unbanked in developing countries, lending platforms exploded at a large scale. In Indonesia, credit lending through P2P platforms hit IDR 22.67 trillion (US$1.62 million), a 645% year-on-year increase in 2018. Similarly, in China, household debt rocketed to a record 55 trillion yuan (US$6.8 trillion) in 2019 due to the rise of online lenders like Ant Financial and Qudian.

As a result, banks in these countries to maintain their market ergo wallet shares were forced to be a bit more flexible with their lending criteria to compete. COVID-19 outbreak accelerated these financial institutions’ exposure to risks. Countries that are hit hardest by the pandemic will see credit quality deteriorating quickly. An estimated 8 million people in China lost their jobs in February, causing overdue credit-card debt to swell in March by about 50% from the year before.

A recent International Labour Organization report estimated global job losses of almost 25 million, with income losses of as much as $3.4 trillion. Credit default rate will aggravate if unemployment climbs further. When consumers face economic hardship and are not able to pay all their bills, personal loans are considered the lowest priority on their list.

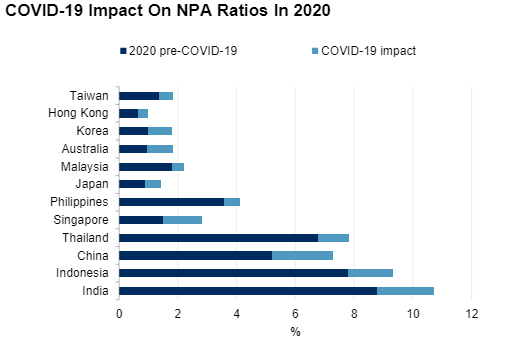

These default risks are precarious as they can put lenders out of business. Non-performing assets and subsequent credit losses in Asia-Pacific banks could rise by $600 billion and $300 billion respectively. More specifically, India could see an increase of $25 billion with Indonesia seeing a spike of US$6 billion in non-performing assets! To protect its banks and ensure a main street problem doesn’t devolve into a wall street problem, governments around the world have designed extraordinary economic stimulus packages to protect and ease the economic repercussion of COVID-19 on consumers, small businesses and financial institutions.

Measures from governments worldwide

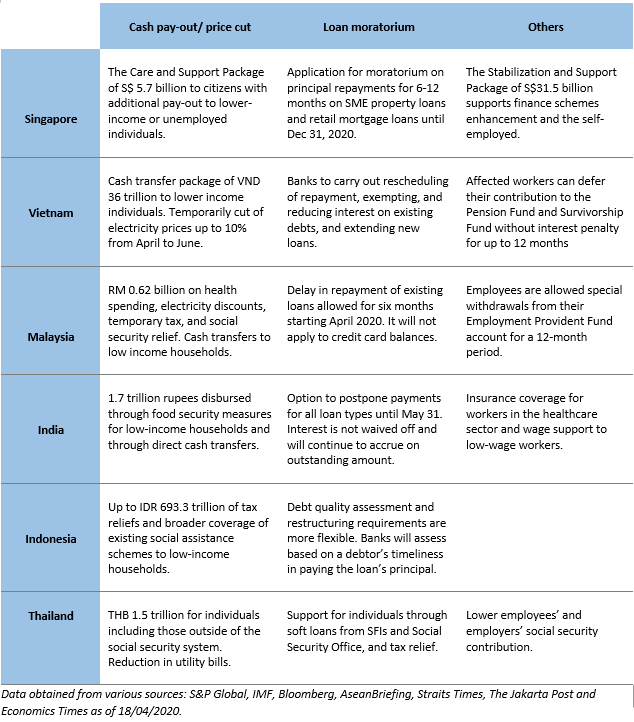

Central banks in Asia have started to assist consumers with immediate financial relief including providing loan payment moratoriums, cutting interest rates close to zero and stabilising the financial markets with tax breaks and unemployment support to retrenched workers.

The table below represents selected APAC countries and the measures proposed by the respective governments to support individuals:

The impact on non-performing loans are usually mitigated by the banks’ adequate capital buffers. At present, banks are likely to face slower credit and profit growth rather than take heavy hits to asset quality. The key focus is on supporting consumers and businesses with debt restructuring measures than looking to improve their NPL ratio.

Caution for the next two quarters

After three to six months of debt moratorium, banks’ balance sheets will be stretched. There will be a surge in debt collection activities or even selling off these debt portfolios. Hence, it will get challenging for banks if the outbreak persists. Credit markets may continue to dampen despite stimulus.

A high volume of NPLs will cause a significant drag on a bank’s performance in the form of lower interest income, additional capital requirement for high-risk weighted assets, lower ratings and a reduced risk appetite for new lending. Moody’s Investors Service reported that COVID-19 has come at a time when APAC banks are already facing tough times, led by slowing economic and credit growth and falling interest rates. Their asset quality will be weakened, and it will also be harder for banks to continue to provide liquidity due to market volatility.

Therefore, to significantly maximise debt collections success in the following months, banks need to apply innovative collections strategies. There is no one-size-fits-all solution. Putting consumers first is the key while adjusting the collection strategies to best fit the current situation of meandering through the outbreak and various government measures.

The three pressing steps for banks to take note:

1. Demonstrate empathy to consumers

An abrupt economic slowdown that will cause challenges to aid delinquent consumers and efficiently service debt poses a distressing threat to effective collection operations. It is pertinent at times like this to demonstrate commitment to helping consumers. Motivate consumers using data-driven knowledge and understand that consumers’ behaviours is a key driver for effective debt recovery.

Important specially to emerging markets, promote ethical debt collection and improve financial literacy through customer education to help these consumers become debt-free. Consumers will be reassured and appreciate these efforts especially in times of extreme uncertainty like now. Financial institutions that take advantage of this situation and try to enhance the relationship with a borrower will ensure a much stronger long term with their customers.

2. Go digital debt collection

With social distancing in place, digital channels for customer communications and self-service will become the new normal. Already, the increase usage of digital services and streaming may be indicating a predictable but widespread shift away from brick-and-mortar to digital channels.

Lenders must follow this trend for consumers in debt, rapidly building digital channels for communication, self-service, and payment. Elevate the customer experience received through interactions with a call-centre employee via online channels, multiple payment options and debt-relief solutions. Above all, lenders must prioritise outreach and communication with concerned customers.

3. Offload loan portfolios with limited upside

The global loan market is more uncertain for the next six to twelve months. Many stimulus measures are designed to tide over a short period to assist struggling individuals, households, and businesses at risk of failure.

Hence, banks with unsecured loans that have limited upside potential after an internal analysis are suitable for sale. After the 2007 financial crisis, many European banks offloaded or exited certain loan products that are not considered to be part of their strategy or risk appetite. Reducing NPL portfolios is also considered to improve the robustness of the banks’ balance sheets.

Ensuring stability despite uncertain outlook

After an in-depth look at the performance of NPL during and after the outbreak, some questions prevail. Will banks still give out as much loan as before? There is also another consideration of banks reshuffling their internal resources that are available and considering their priorities for the new normal. Right now, with the outbreak still overwhelming most countries, economists are still guessing what shape the post-COVID-19 economic recovery will take.

Governments across the globe are already in overdrive taking the necessary steps to ensure stability. In this climate, it is hard to assess the effects of this pandemic on lenders’ balance sheets. That being said, the dark clouds of economic uncertainty are here to stay for the foreseeable future and instead of taking a kicking the can down the road approach, it is imperative that lenders undertake a full CT scan of their balance sheets and work actively with their debt management partners on nursing it back to health!

International (EN)

International (EN) Indonesia (ID)

Indonesia (ID) India (EN)

India (EN)