The second year of COVID-19 pandemic has taken a significant toll on Asian economies as businesses and individuals struggle to stay afloat financially. Indonesia was one of the economies heavily battered as the pandemic triggered austerity measures. Fast forward, the economy is slowly bouncing back thanks to aggressive vaccination campaigns and accommodative monetary policies. Vietnam credit industry is facing its biggest test yet as the economy tries to bounce back from the slowdown. The ratio of non-performing loans (NPL) has been increasing over the last three quarters. The increase has been necessitated by the fact that borrowers are no longer able to service their loans assumed pre-pandemic.

Amid the turmoil and disruptions triggered by the pandemic, it’s becoming increasingly clear that conventional debt recovery methods may not work. Consequently, Flow has re-evaluated the best way to approach and deal with borrowers amid the volatile credit situation in the country

For instance, in Vietnam, following the government’s crackdown of third party and unethical collectors, Flow study shows that lenders and collectors need to implement sound collection strategies. The collection strategies should entail ethical standards well-controlled and incorporated into the tools and rules. Given that borrowers in vulnerable circumstances are volatile, it calls for specific soft skills while handling them.

The lack of a stable source of income has seen many borrowers struggle to repay the principal, let alone interest owed to credit firms. Payment behaviors have also changed significantly as borrowers remain furloughed, with others having been dismissed from their jobs.

Lenders and collectors are also finding the going tough in their push to recover some of the funds loaned out. With consumers much more sensitive than ever when contacted by debt recovery agencies, a change of tact is crucial if debt collectors are to enjoy any success in debt recovery. Flow carried out an extensive survey with our borrowers in India, Indonesia and Vietnam to better understand the borrower’s situation during the COVID-19 pandemic.

Methodology

The survey questions and interviews focused on how COVID-19 has affected borrowers’ repayment behavior going by the loss of income and jobs that have come into play.

Flow marketing team came up with qualitative survey questions that analyzed borrower’s unique behaviors amid the pandemic. Flow’s Risk team settled on a more diverse list of borrowers for the survey to ensure fair distribution across different portfolio types; to better understand India’s credit situation. The Quality Assurance team contacted the borrowers who answered specific questions as part of the survey. The results were collated by the Marketing team and analyzed by the Strategy team.

Flow relied on simple data analysis techniques to analyze the data from where insights are to be drawn from raw data to determine the best way to approach borrowers in the future.

Results

- What is the overall outlook of the Asian economic outlook moving forward?

According to the survey result, the impact of lockdown restrictions is increasingly being felt, as alluded by the survey responses. Going by the results, it appears more than 50% of the borrowers remain unsure about the economic situation improving soon. The majority are unsure of the economy bouncing back, with a good number of people who believe COVID-19 will have a long term impact.

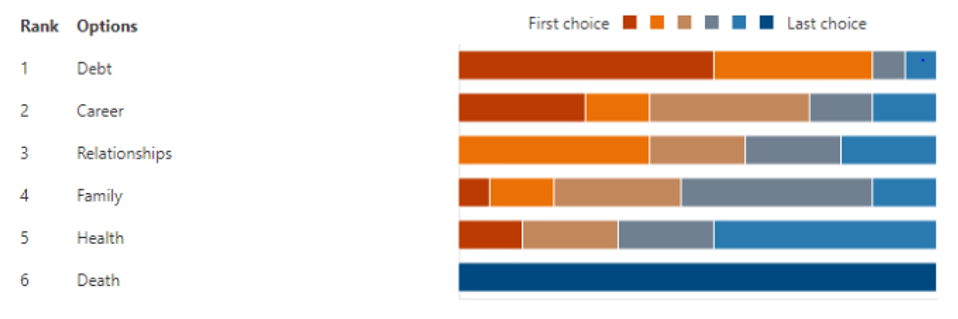

- How does debt compare to your other stressful events?

Debt remains the biggest trigger point of stress levels than anything else among borrowers going by the survey results. Rivaling debt as a major concern are issues related to careers as another trigger point, with relationships issues also appearing to be strained amid the pandemic.

- How confident are borrowers of debt levels?

A majority of the borrowers in the Flow survey are confident of being in control of their debt levels with 33% extremely confident and 33% somewhat confident. This is despite debt collectors finding themselves in a tight spot on pursuing borrowers and having them repay their loans.

Given that some people are somewhat and not all confident about being in control of their debt levels all but raises the prospects of lenders ending up with a significant chunk of bad debts in Asia.

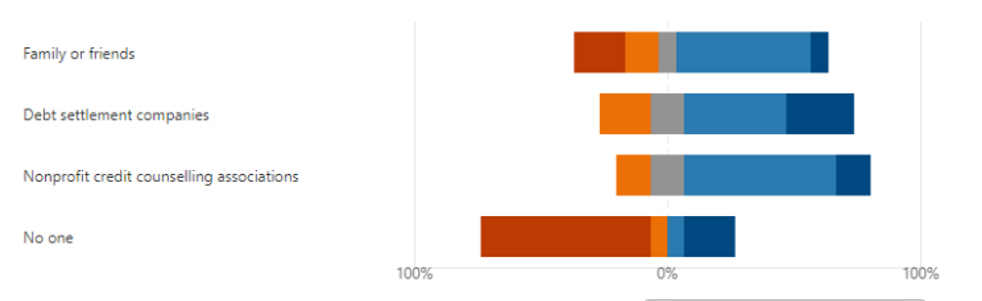

- While struggling with debt, where would you seek help?

With many borrowers insisting on being in control of their debt situations, it does not come as a surprise that most of them are not in a rush to seek help. However, it should arouse serious concerns given that most of the surveyed hinted at their unwillingness to seek help from debt settlement companies or even nonprofit credit counseling associations.

Most borrowers only hinted at seeking help to settle their debts from family and friends or not seeking any help at all.

- What method do you think is the best debt settlement option?

According to the study, given the option of sitting down with debt settlement companies, 40% of the borrowers would push for lower interest rates to enable swift repayment of the loan owed.

Additionally, request for onetime payment seems to board well with 33% of the borrowers most people with very few people of the opinion to reschedule repayments. Request for debt forgiveness appears not to be an option for all the borrowers.

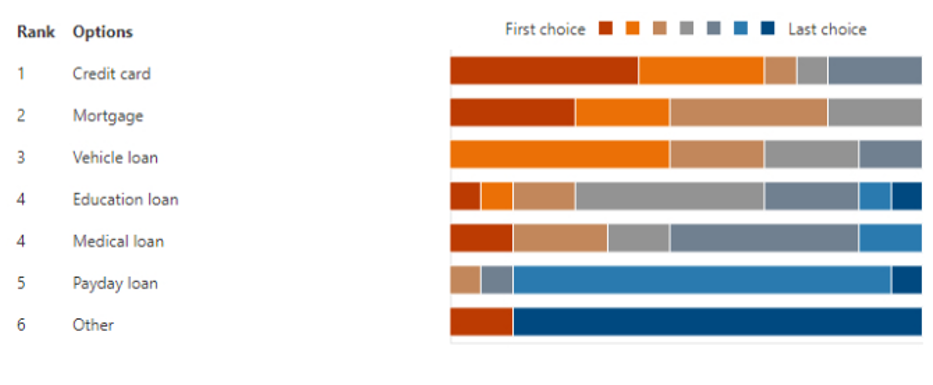

- What types of loan would you prioritize while repaying?

Weighed down by an array of loans, it seems most people would prioritize the payment of credit card loans than anything else. Mortgage repayment comes close second, followed by Medical loans. Flow survey also shows that most people pay close watch to Vehicle loans, with the least attention being paid to payday loans.

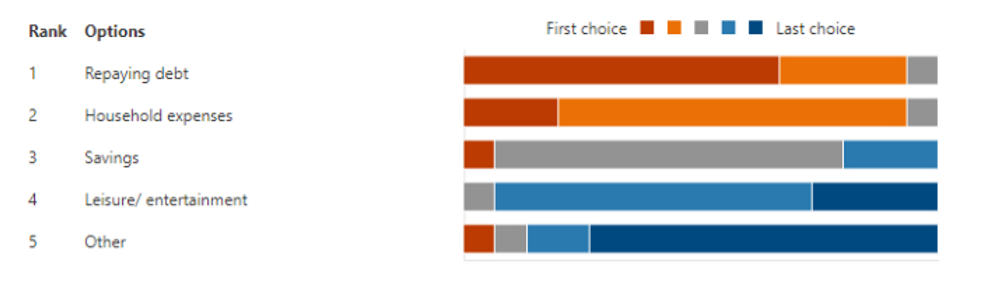

- What is your first priority when salary kicks in?

According to Flow’s survey, debt repayment is top on the list for borrowers sure of getting a salary in Asia. Catering to household expenses follows a close second, with the least attention being given to leisure/entertainment and savings.

- What is the preferred loan repayment reminder mode?

Debt collectors are being urged to come up with more innovative ways in debt collections. However, it seems most people are okay with being contacted via SMS and calls whenever debt collectors wish to remind them of the need to repay money owed.

However, it is also becoming clear that most of the borrowers don’t want to be contacted about their loans amid the COVID situation. The situation becomes worse whenever the debt collectors make multiple calls.

Understanding borrowers for a more effective recovery

Going by the Flow survey, it is clear that debt recovery is a big challenge at a time when some borrowers in Asia have lost crucial income streams due to the pandemic. However, debt collection can be less challenging if the lenders and collectors make the borrowers understand they care about them and are there to ensure they service their loans in the most comfortable way. The study shows it is no longer about using intimidating tactics or field collection, but relying on friendly approaches to interact with borrowers.

Asia’s credit industry finds itself in a precarious position amid the disruptions and strains triggered by the pandemic. While debt collectors have a responsibility to deploy all the necessary tools on their disposal to push borrowers to repay their loans deploying traditional tactics may not cut it. For borrowers who have fallen behind in their debt payments, debt collectors should opt to understand the cause of the problem first. This is the only way they will be able to understand the underlying problem and come up with necessary assistance that will get the borrowers back on track to repay their loans. Intimidating borrowers may never work amid the changing times.

International (EN)

International (EN) India (EN)

India (EN)